nj bait tax instructions

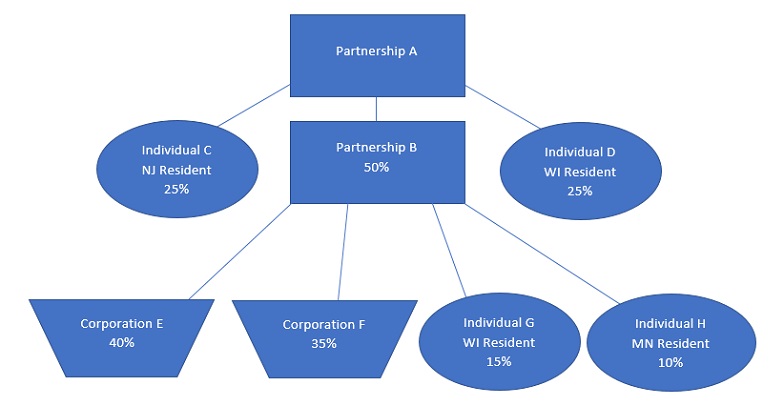

Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members. Bracket Changes As a result of the amendments the BAIT increases to the top rate of 109 on firm income over 1M.

Nj Division Of Taxation Pay Tax

Good News in New Jersey.

. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax. The New Jersey Division of Taxation has provided answers to several recent questions about the New Jersey Business Alternative Income Tax BAIT. The BAIT is imposed at the following rates based on the collective sum of all the PTEs members shares of distributive proceeds for the tax year.

NJ BAIT Apportionment Factor For tax year 2021 S Corporations will have the option of using the single sales factor or the three-factor formula Sales Payroll Property to. The concerns of passthrough. Business Alternative Income Tax BAIT Now ImprovedTaxpayer concerns result in modification of prior law.

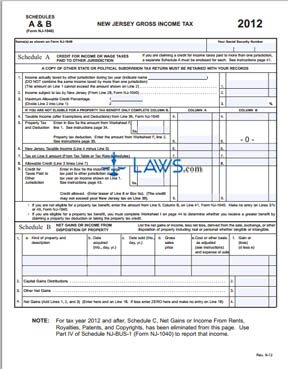

PTE Tax Return Form PTE-100 reference copy Instructions. PL2019 c320 enacted the Pass-Through. Instructions for Completing the.

The New Jersey Business Alternative Income Tax or NJ BAIT allows pass-through businesses to pay income taxes at the entity level instead of the personal. On January 13 2020 New Jersey Governor Phil Murphy signed the NJ SB3246 Pass-Through Business Alternative Income Tax Act into law. New Jersey PTEBAIT returns originally due between March 15th and June 15th 2022 are now due by June 15th 2022.

Pass-Through Business Alternative Income Tax Act. If the sum of each members. General Instructions for New Jersey S Corporation Business Tax Return and Related Forms - 2 - 187-116a1 through a7 must file the New Jersey Corporation.

The program will calculate the Pass-Through. Pass-Through Business Alternative Income Tax Act. September 3 2021.

This is an entity-level tax to work. Underpayment of Estimated Pass-Through Business Alternative Income Tax Form PTE-160 Extension of. To access the NJ.

Until 2022 there is a middle bracket of 912 for. New Jersey Pass-Through Business Alternative Income Tax PTE Election.

Ami Shah Cpa Certified Public Accountant Ami Shah Cpa Pc Linkedin

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

New Jersey State Tax Updates Withum

New Jersey Partnership Tax Login

Nj Bait Deduction Lear Pannepacker Llp

Nj Division Of Taxation File Pay

New Jersey Pass Through Business Alternative Income Tax Act Curchin Nj Cpa

New Jersey Extends Due Date For Bait Elections Marcum Llp Accountants And Advisors

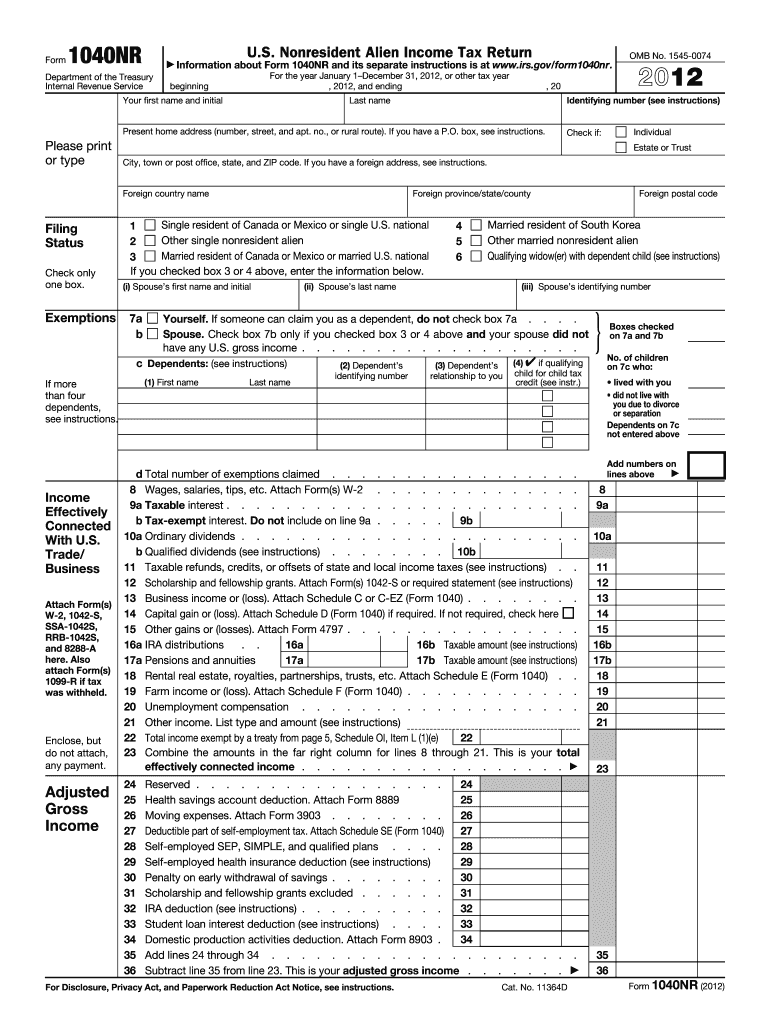

2012 Form Irs 1040 Nr Fill Online Printable Fillable Blank Pdffiller

Mouse Guard Snap Traps 4 Pack Wood Metal Rodent Pest Control Supply No Poison Ebay

Mansour Partners Llc Woodbridge Nj

![]()

Search Njcpa Events And Cpe Programs

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax

The Nj Pass Through Business Alternative Income Tax Act Alloy Silverstein

Boat Registration Page 2 Boating Nj Woods Water

New Jersey State Tax Updates Withum

Form Nj 1040nr Fillable Non Resident Income Tax Return

Nj Bait And New Salt Guidance What You Need To Know Smolin

4 New 2021 Tax Forms Analysis Amp Illustration Line By Line Exampl Ace Seminars